If you are forming a Nebraska LLC, then this page’s content would be vital. As you learn how to start an LLC, you will realize that the bulk of your initial work and LLC cost comprises filing a Nebraska certificate of organization, which we will elaborate on this page.

On this page, you’ll learn about the following:

What is a Certificate of Organization?

A Certificate of Organization, also known as an LLC certificate or Articles of Organization in some states, is a document filed with the secretary of state to form an LLC.

Each state has a different requirement to fill out a form. A Certificate of Organization usually includes the following:

- The name of the LLC,

- the effective date of the LLC,

- the company’s principal office,

- the business purpose,

- the duration of the business,

- a copy of the LLC’s name registration certificate, and

- the name and address of the registered agent, organizers, and

- at least one member of the company.

You can file a Certificate of Organization online, by mail, or in person.

Note that the certification of formation is a legal requirement, not to mention, the core of your LLC formation. It even makes up the bulk of your Nebraska LLC cost. Without it, you have no LLC. So, take the time to complete and file this certificate.

How to File an Nebraska Certificate of Organization

These are the simple steps to follow in filing a Certificate of Organization in Nebraska.

Step 1: Find Forms Online

Go to the Nebraska Secretary of State to download the certificate of organization form for your LLC or to log into the online service.

Step 2: Fill Out Form

When filling out the form, you must have reserved an LLC name. Do a name search. Go to Nebraska LLC Name Search to check whether your chosen business name is available to use in this state.

You must attach a copy of your Name Reservation to your filled-out Certificate of Organization form when filing. You also need to nominate a registered agent. Here are 3 of the best LLC services on our list.

Step 3: File Formation Certificates

File your formation certificate either online or by mail by filling out a form and sending it to Robert B. Evnen, Secretary of State, P.O. Box 94608, Lincoln, NE 68509.

Filing Nebraska Certificate of Organization Online

Time needed: 5 minutes

To set up your business LLC in the State of Nebraska, you must apply for the Certificate of Organization of your Nebraska LLC. The State offers both online as well as offline filing. When applying through online mode, your application is processed immediately. The formation guide in the following steps will help you file for the Nebraska LLC Certificate of Organization, so read on and get info.

- Visit the Official Website of the State of Nebraska

Go to the Official Nebraska Secretary of State website. The Corporate Document eDelivery portal on the State website allows you to submit your business-related documents electronically with the Secretary of State office.

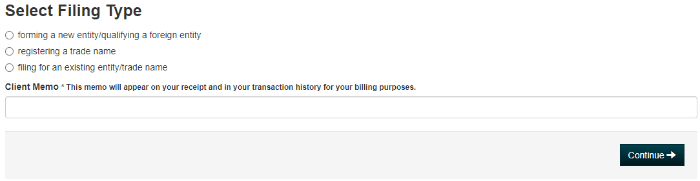

- Select the filing type

On the given page, scroll down the page to Select the Filing Type and click on the option of ‘Forming a new entity/ qualifying a foreign entity’.

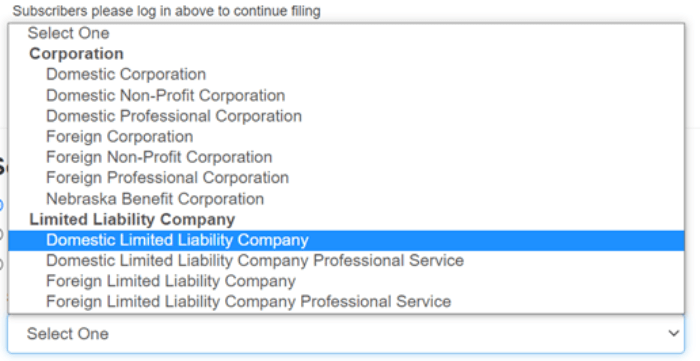

- Select the Entity type

After selecting the ‘forming a new entity’ option, you need to select the entity type by clicking on the drop-down box. From this box, under the heading of ‘Limited Liability Company’ select the option of ‘Domestic Limited Liability Company’.

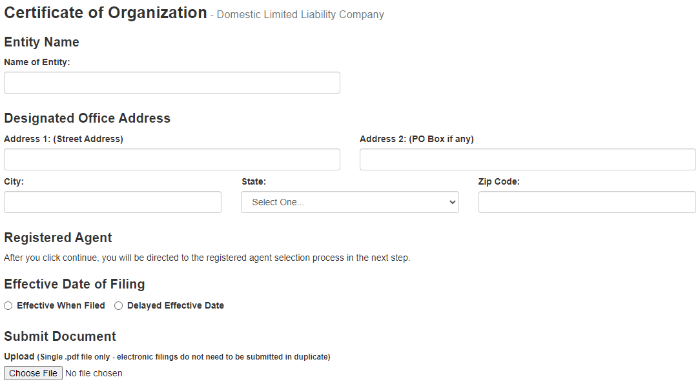

- Proceed to Registration

On the next page, start filling in the required information in the Certificate of Organization form. Fill in the entity name, designated office address, and registered agent details. You also need to select your effective date of filing, whether it be considered from the date when filed or if there is a delayed effective date. Next, upload your documents in pdf format. Note that all the documents should be arranged as a single file only. After filling in all the details, press the ‘Continue’ tab.

- Review the information

Before submitting your application, review all the information entered by you in the application thoroughly. All the information should be correct and accurate.

- Make the payment

On the final page, you will be asked to proceed to the payment gateway page. Make the payment of $100 as an online filing fee for your Certificate of Organization.

After submitting your application, you will receive a notification confirming your application from the State office.

Filing Nebraska Certificate of Organization by Mail

If you wish to file your Application of the Nebraska LLC Articles of Organization by mail, you can do that by mail as well. The State does not offer a standard template for filing, rather provides a set of instructions for the same.

- Access the Instructions by the State of Nebraska to abide by the filing instructions.

- Create your own form following the given set of instructions.

- You can also attach the name reservation certificate.

- Review the overall application to be correct and accurate as per the State guidelines.

- Make the payment of $110 payable to the ‘Secretary of State’.

- Send the documents to the following address, Secretary of State, P.O. Box 94608, Lincoln, NE 68509

Cost of filing a Nebraska Certificate of Organization

It is easier and more convenient to file for the Certificate of Organization through online filing than by offline filing. The overall cost to form a Nebraska LLC via mail is higher than online filing. Here is the cost of filing formation articles in Nebraska

- Online filing costs $100

- By mail filing costs $110

F.A.Qs

A Certificate of Organization is a legal document that will officially make your LLC into existence. This document is needed specifically for Nebraska in forming an LLC business structure.

The application form for the Certificate of Organization needs to include the LLC name, date of establishment, the company’s registered office, business purpose, how long the business will exist, and a copy of the LLC’s name registration certificate.

Filing by mail or in person is neither highly recommended nor required; waiting an extra week for your LLC to be approved isn’t that bad. The LLC approval you send in will be returned by mail. Online filing, meanwhile, is more convenient as you won’t have to stay in a queue.

Where Can You Find Your Nebraska LLC Certificate of Organization

You have to create your own Certificate of Organization for Nebraska LLC by filling in the necessary details and then file it online or via mail. You can read the requirements about it on Nebraska Legislature website.

So, where can you find your Nebraska LLC Certificate of Organization? The process for obtaining this document is relatively simple and can be completed online through the Nebraska Secretary of State’s website. After you have filed the necessary paperwork and paid the required fees to register your LLC, you will receive a confirmation email with a link to download and print your Certificate of Organization.

It is important to keep this document in a safe place, as you may need to provide it to banks, investors, and other business partners as proof of your LLC’s legal status. Additionally, having your Certificate of Organization on hand can help you establish credibility and build trust with potential clients and customers.

If you have misplaced or lost your Certificate of Organization, you can easily request a copy from the Nebraska Secretary of State’s office. Simply fill out a request form and pay a small fee, and a duplicate copy of your Certificate will be sent to you promptly.

Having your LLC Certificate of Organization is not only a legal requirement but also a valuable tool for establishing and growing your business. By keeping this document organized and easily accessible, you can avoid potential legal issues and demonstrate to others that your business is legitimate and trustworthy.

In conclusion, obtaining and keeping track of your Nebraska LLC Certificate of Organization is an essential part of being a responsible business owner. By following the steps outlined above, you can easily obtain this document and ensure that your business is in compliance with state regulations. Let your Certificate of Organization be a badge of honor that showcases your commitment to running a successful and legally compliant business in the state of Nebraska.

In Conclusion

Articles of Organization or Certificate of Formation is the most important document for your Nebraska LLC. Before you submit/file the document make sure to provide proper and correct information about your company. If you have any questions, share that below in the comment section.