If you are forming an LLC in CT, then this page’s content would be vital. As you learn how to start an LLC, you will realize that the bulk of your initial work and cost comprises filing a certificate of organization, which we will elaborate on this page.

On this page, you’ll learn about the following:

What is a Certificate of Organization?

A Certificate of Organization, also known as an LLC certificate or Articles of Organization in some states, is a document filed with the secretary of state to form an LLC.

Each state has a different requirement to fill out a form. A Certificate of Organization usually includes the following:

- The name of the LLC,

- the effective date of the LLC,

- the company’s principal office,

- the business purpose,

- the duration of the business,

- a copy of the LLC’s name registration certificate, and

- the name and address of the registered agent, organizers, and

- at least one member of the company.

You can file a Certificate of Organization online, by mail, or in person.

Note that the certification of formation is a legal requirement, not to mention, the core of your LLC formation. It even makes up the bulk of your LLC cost. Without it, you have no LLC. So, take the time to complete and file this certificate.

How to File a Connecticut Certificate of Organization

These are the simple steps to follow in filing a Certificate of Organization in Connecticut.

Step 1: Find Forms Online

Go to the Connecticut Secretary of State to download the certificate of organization form for your LLC or to log into the online service.

Step 2: Fill Out Form

When filling out the form, you must have reserved an LLC name. Do a name search. Go to Connecticut LLC Name Search to check whether your chosen business name is available to use in this state.

You must attach a copy of your Name Reservation to your filled-out Certificate of Organization form when filing. You also need to nominate a registered agent. Here are 3 of the best LLC services on our list.

Step 3: File Formation Certificates

File your formation certificate either online or by mail by filling out a form and sending it to the Business Services Division Connecticut Secretary of the State P.O. Box 150470 Hartford, CT 06115-0470.

File Connecticut Certificate of Organization by Mail

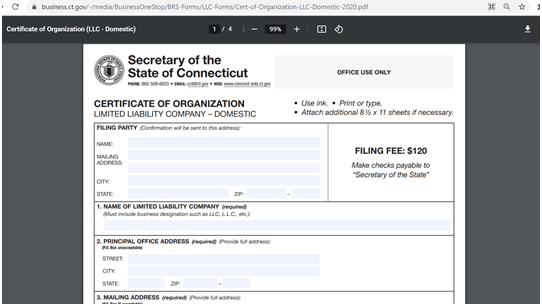

You can directly access the form “Certificate of Organization” from the Official Website. This form then should be mailed to the Official ID of the Secretary of State of Connecticut. Download Now

While making the payment, make the cheques payable to “The Secretary of the State.”

Mailing Address:

Business Services Division

Connecticut Secretary of the State

P.O. Box 150470

Hartford, CT 06115-0470

Website: www.concord-sots.ct.gov

Delivery Address:

Business Services Division

Connecticut Secretary of the State

165 Capitol Avenue, Suite 1000

Hartford, CT 06106

Phone: 860-509-6003

File Connecticut Certificate of Organization by Online

There are two methods for you to do the online filing of your Connecticut Certificate of Organization.

Method 1:

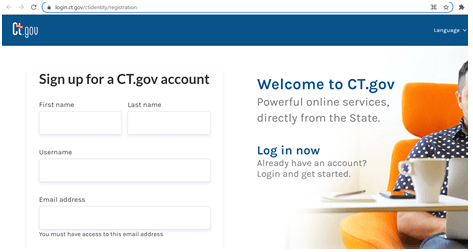

Visit the official website of Online Business Services of the Secretary of the State of Connecticut. Create your account on the page by clicking on “Sign-in here to get started”.

Next, select “Business Formation” under “What Would You Like to Accomplish Today”. Lastly, select “Domestic Limited Liability Company” and proceed with further information filing.

Method 2:

1. Visit the login/register page on the official website.

2. Select “Register your business”.

3. Next, select “Domestic” and “Limited Liability Company (LLC)”.

4. Continue to fill in all the required details on the following pages.

5. Review the information you have provided thoroughly. If you wish to make any changes, click the “Edit” option. Then, proceed to the next step.

6. For the “Payment” page, check the box agreeing to the terms and conditions and click “Continue to Payment”. Fill in your billing information and submit your application. Now, you have successfully filed your application for forming an LLC in Connecticut. The application is generally processed in 2-3 business days. After approval from the State Authorities, you will receive an email consisting of a Certificate of Organization and an Acceptance Letter.

F.A.Qs

A Certificate of Organization is a legal document that will officially make your LLC into existence. This document is needed specifically for Connecticut in forming an LLC business structure.

The application form for the Certificate of Organization needs to include the LLC name, date of establishment, the company’s registered office, business purpose, how long the business will exist, and a copy of the LLC’s name registration certificate.

Filing by mail or in person is neither highly recommended nor required; waiting an extra week for your LLC to be approved isn’t that bad. The LLC approval you send in will be returned by mail. Online filing, meanwhile, is more convenient as you won’t have to stay in a queue.

Where Can You Find Your Connecticut LLC Certificate of Organization

Certificate of Organization for Connecticut LLC can be accessed through the Connecticut Secretary of State website. You can also download the PDF from the same website.

So, where can you find your Connecticut LLC Certificate of Organization?

The first and most straightforward place to look for your Certificate of Organization is the office of the Connecticut Secretary of State. This is where all business registration documents are typically filed and stored. To locate your LLC’s Certificate of Organization, you can visit the Secretary of State’s website and search for your business entity by name or file number. Once you have located your LLC, you should be able to view and download a copy of your Certificate of Organization directly from the website.

If you prefer to obtain a physical copy of your Certificate of Organization, you can request one from the Secretary of State’s office by mail or in person. Simply complete a request form and pay any required fees, and a copy of your Certificate of Organization will be sent to you.

Another option for finding your Connecticut LLC Certificate of Organization is through your registered agent. A registered agent is a designated individual or company responsible for receiving legal documents and official correspondence on behalf of your LLC. Your registered agent should have a copy of your Certificate of Organization on file, as it is a critical document for your business operations. If you are unable to locate your Certificate of Organization through the Secretary of State’s office, your registered agent may be able to provide you with a copy.

Additionally, if you used the services of an attorney or business formation service to set up your LLC, they may also have a copy of your Certificate of Organization. It is common practice for professionals assisting with LLC formation to retain copies of key documents for their clients. Reach out to the individual or company that helped establish your LLC to inquire about obtaining a copy of your Certificate of Organization.

In conclusion, if you are wondering where to find your Connecticut LLC Certificate of Organization, the most likely sources include the Secretary of State’s office, your registered agent, or the professional entity that assisted with your LLC formation. By being proactive in obtaining and keeping track of this essential document, you can ensure that your LLC remains compliant with state regulations and is able to operate smoothly and effectively.

In Conclusion

Articles of Organization or Certificate of Formation is the most important document for your Connecticut LLC. Before you submit/file the document make sure to provide proper and correct information about your company. If you have any questions, share that below in the comment section.