If you already have an LLC in another state and want an LLC in Alabama, then starting an LLC would be somewhat different. You must register as a foreign LLC. We have here a guide on how you can qualify and register for a foreign LLC in Alabama.

On this page, you’ll learn about the following:

Forming an Alabama Foreign LLC

A foreign LLC does not need to be a company from another country but a business formed under the laws of another state. To start a foreign LLC in Alabama, you need to register it with the Alabama Secretary of State.

Step 1: Choose Alabama Foreign LLC Name

Obtain a name reservation certificate and submit it with your foreign qualification requirements at the Alabama Secretary of State. Your LLC’s legal name outside of Alabama will be listed on the application, along with the name it will use in Alabama. Take note of the requirements for naming your LLC.

Check the name availability at Alabama’s business entity names and reserve your LLC name.

Step 2: Select Alabama Foreign LLC Registered Agent

You’ll need a registered agent to form a foreign LLC in Alabama and take note that an Alabama registered agent must have a local address. Here are three of the best LLC services on our list:

Step 3: File Registration of Alabama Foreign LLC

Fill out and submit a Foreign LLC Application for Registration form via email to [email protected] or by mail to Alabama Secretary of State Business Services, P.O. Box 5616, Montgomery, Alabama 36103-5616.

Include the following:

- LLC’s full legal name.

- A fictitious name or a DBA (only if your LLC’s legal name is not available); Attach a statement of adoption of the fictitious name signed by all LLC members.

- LLC’s principal office and mailing addresses.

- LLC formation state and date.

- Registered agent’s name and address in Alabama

- Date when your LLC will start operations in Alabama.

- Credit card information on the last page of the form for the $150 application fee.

The LLC cost in Alabama, even for foreign LLCs will differ between online filing and by mail.

Step 4: Determine How Your Alabama Foreign LLC is taxed

Foreign LLCs are also subjected to the Alabama Business Privilege Tax, and they must file LLC annual reports.

Note that forming a foreign LLC would be good for your business as you can legally operate in a different state thus reaching a larger market and opening more opportunities for higher profit.

Steps to Filing Alabama Foreign LLC Online

Time needed: 5 minutes

With the help of filing a foreign LLC, it will be profitable for you to operate one business entity in different states. The prospect is pretty easy, and if you have an Employee Identification Number (EIN), it would be like a plus point for a speedy process. Let’s move on to the steps to file a foreign LLC in Alabama online.

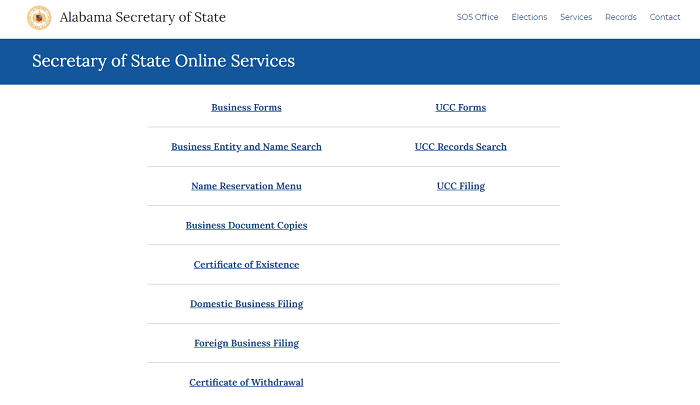

- Visit the website of the Alabama Secretary of State

The very first step that you have to do to file the foreign LLC is to get to the Alabama Secretary of State official website. Once you get to the website, you need to select the options of “services” and then the option of business entities. Click on online services in the menu that appeared, after this, you will reach the webpage of Secretary of State Online Services.

- Select the option of foreign business filing

Now that you are filing the foreign LLC in the state of Alabama, you need to click on the option of foreign business filing.

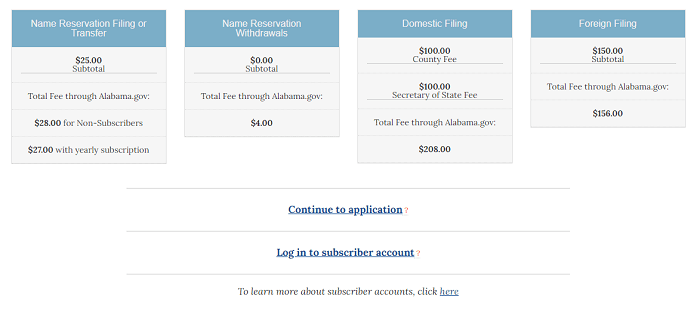

- Click on Continue to Application

After clicking on the “foreign business filing”, you will get to the page which shows the filing fee of different aspects. You will see that the cost to file a foreign LLC is $150 as is mentioned there. You need to scroll down and click on “Continue to Application.”

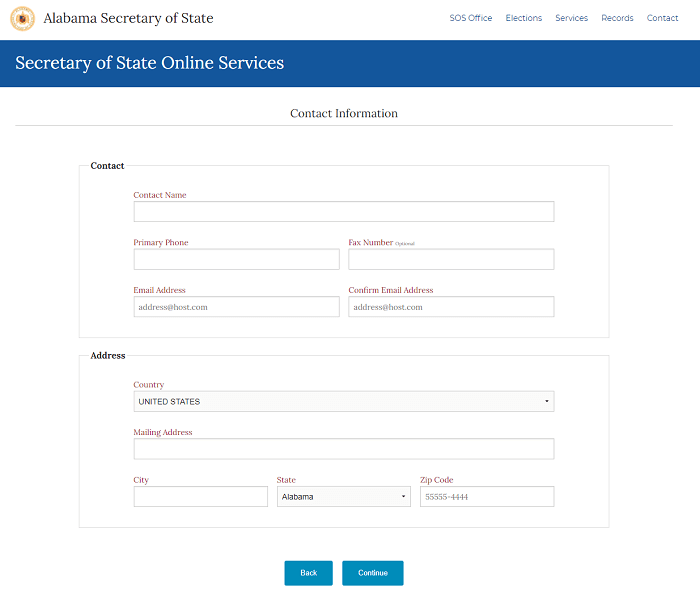

- Add the contact information

When you click on the continue button, you will see the required contact information. You will have to fill in the contact name, phone number, email address, country, mailing address, city, state, and Zip-code. Be sure to fill in the right information. Take note that the address field is not the one for your LLC address, but the address where you live or can be contacted. Press continue to get to another page.

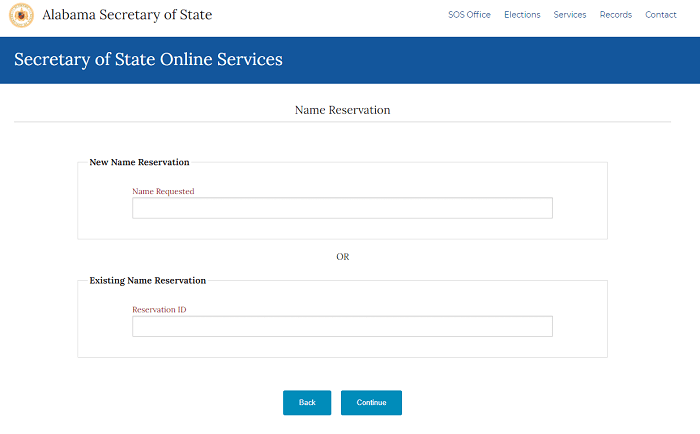

- Name reservation

You have to reserve the name in the state of Alabama even if you have done that before. Qualifying the name is important because it’s possible that the name is already being used by another company. So, select the name reservation option and enter the name.

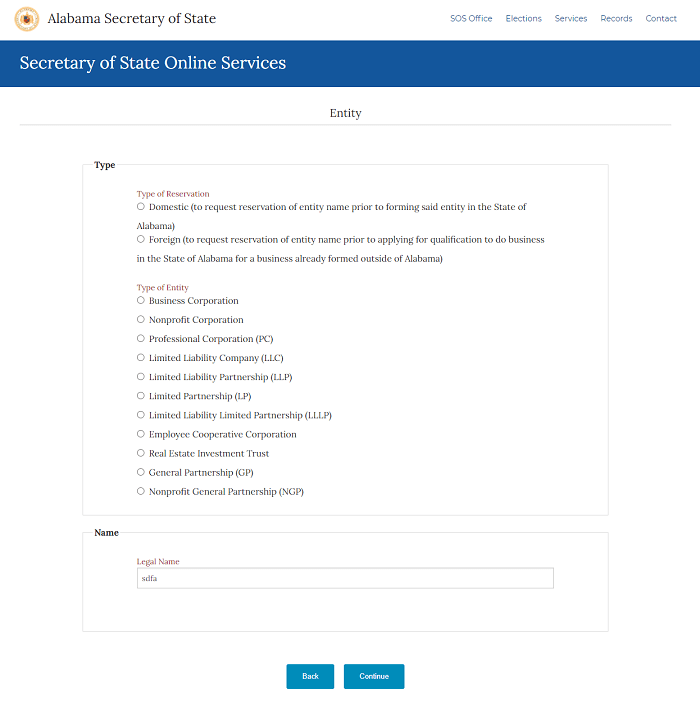

- Select the type of entity

As we know there are two types of entities. It becomes crucial to mention the type of entity and reservation. You need to select the option of “Foreign” here. Then you need to move on to the next point and select “Limited Liability Company (LLC)” because you want a foreign LLC. Now, fill in the legal name of your business and press continue.

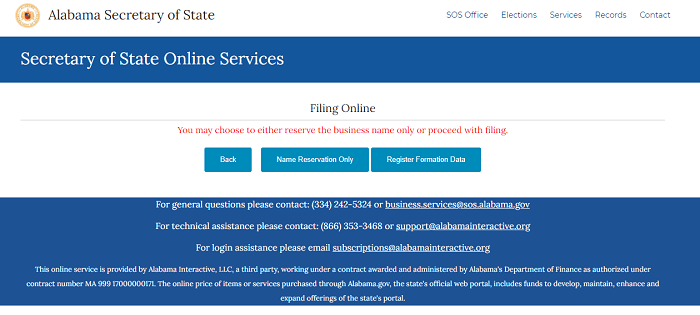

- Step to file online

Lastly, file the foreign LLC by clicking on the “File of formation data” option and continue with formalities.

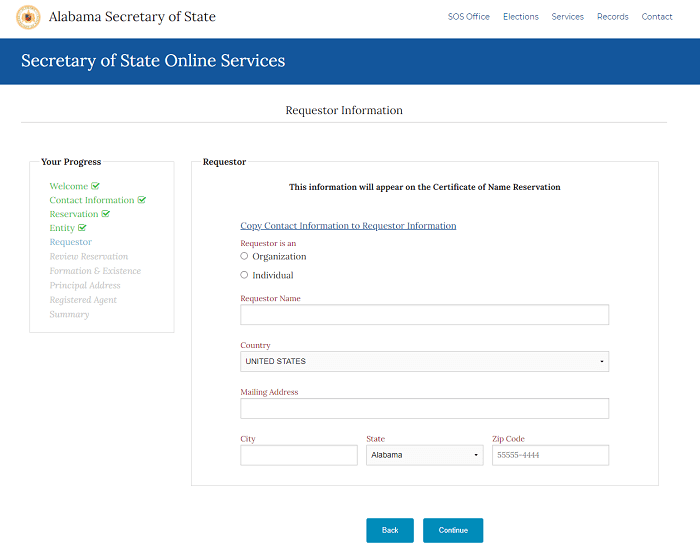

- Requestor Form

As you click on the ‘Registration Formation Data,’ you will land on the Requestor page. You have to indicate who is requesting to form a Foreign LLC. Mention the details and click on Continue to go to the next page.

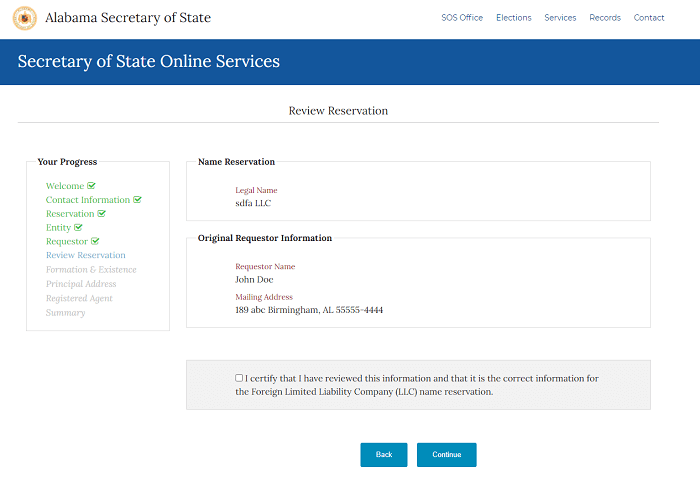

- Review Reservation

On the next page, you will see the entire LLC details you have entered. You can review the details, and if needed, you can go back and change them. If all information is correct, check the box below. Click on the Next button to go to the next page.

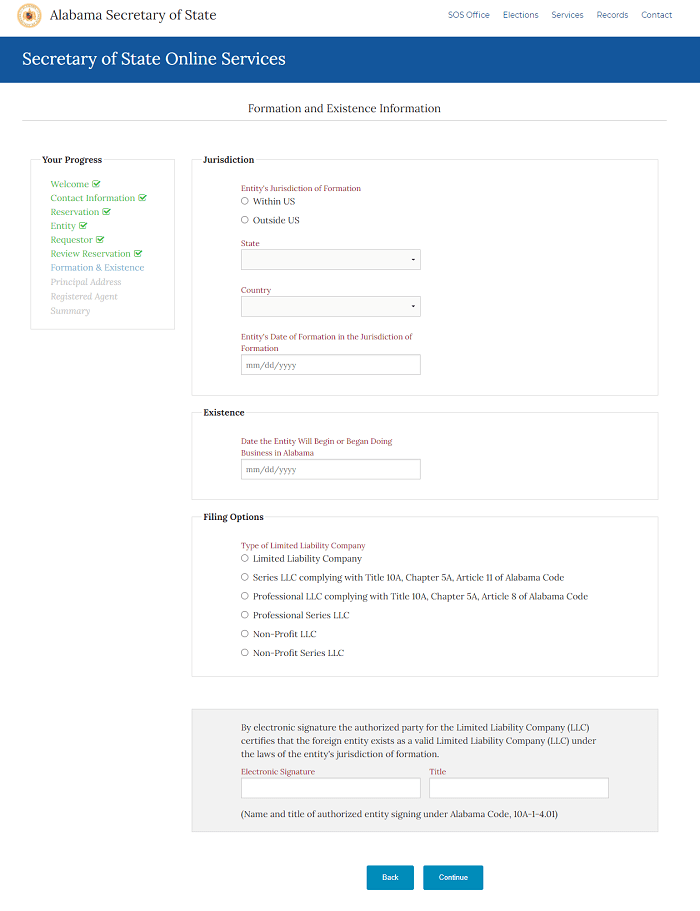

- Formation and Existence

On the next page, mention the formation and existence of your LLC. The state/country where your LLC is located, the date of formation, and the date when the foreign LLC in Alabama will start operation.

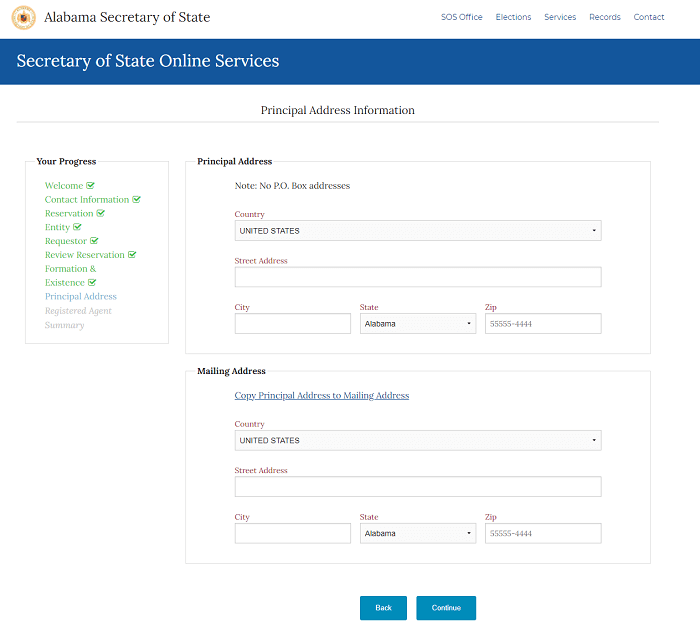

- Principal address

This page will require information about the physical address in Alabama.

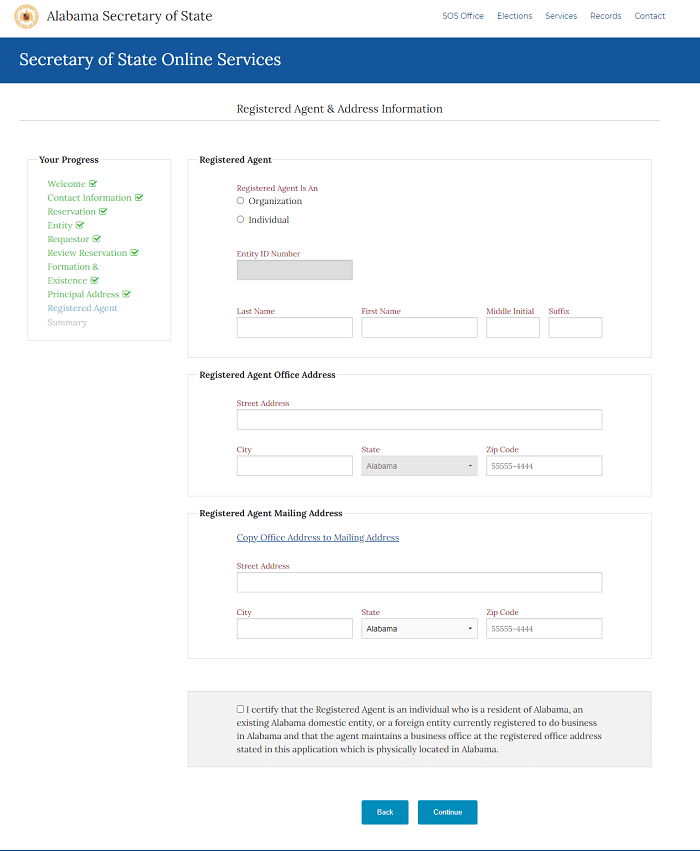

- Registered Agent

You need to nominate your registered agent. Take note that the agent must have a registered address in Alabama.

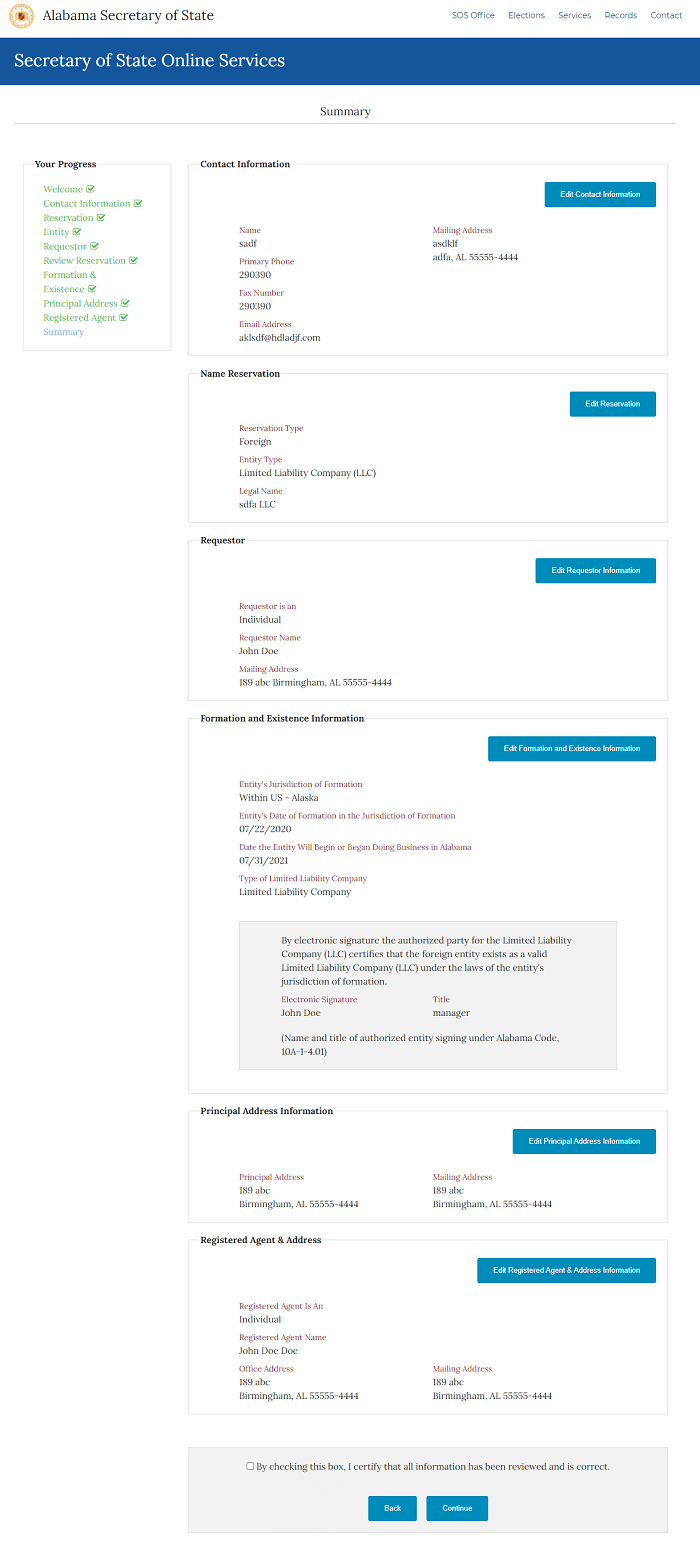

- Review Summary

Here, you will be shown a summary of everything you have encoded thus far. Check the details carefully before proceeding to the next step.

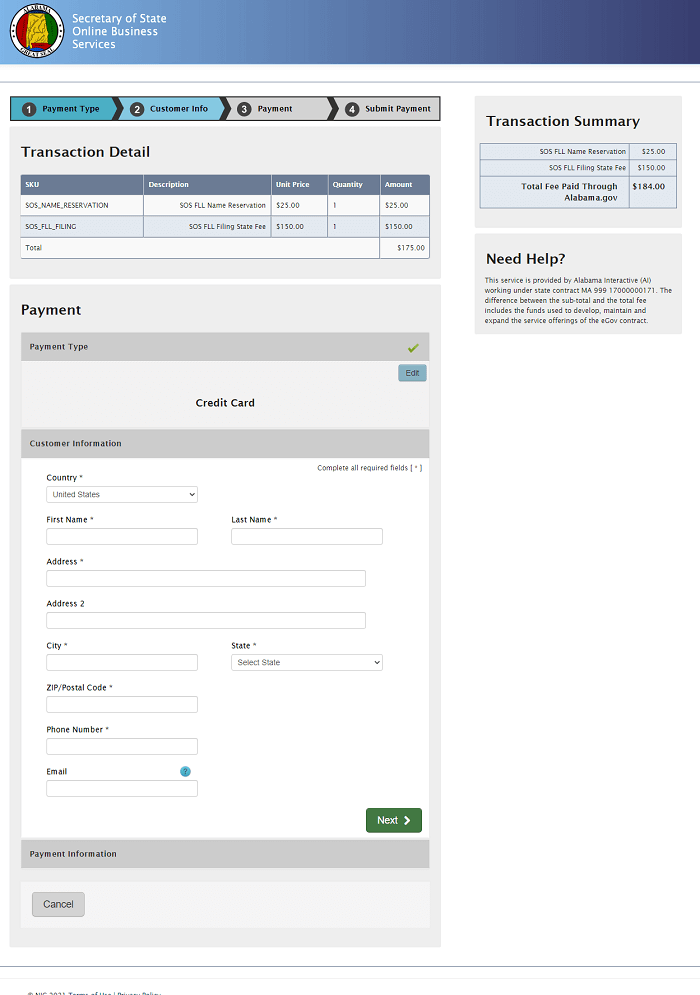

- Payment

After completing the required information, you will reach the Payment page. Make the payment of $150 using your VISA, MasterCard, or American Express card. You will receive the final notification of registering the LLC and payment to confirm that your Alabama Foreign LLC has been registered successfully.

It is convenient plus easy to file for the foreign LLC if you are doing it online. The steps are very easy and that’s why it’s possible to go along with the steps and form the foreign LLC in Alabama.

After Forming Alabama Foreign LLC

Here are added things you need to accomplish after forming your Alabama Foreign LLC

- Obtain business licenses. Find the business licenses you’ll need using the Business License Search.

- File LLC annual reports and Business Privilege Tax.

- Pay State Taxes like sales tax; you’ll need an EIN for your LLC.

F.A.Qs

If your LLC is formed under the laws of another state, it is referred to as a foreign LLC in Alabama.

Businesses incorporated outside of the state where they operate must have “foreign qualifications” issued in the other states.

A domestic LLC is a company registered in Alabama as an LLC. The entity type that has a physical presence in another state is a foreign LLC.

How Much Does It Cost to Register a Foreign LLC in Alabama

To register as a foreign LLC in Alabama, you can file through mail or online by paying a filing amount of $150 to the Alabama Secretary of State.

One of the primary costs associated with registering a foreign LLC in Alabama is the filing fee. This fee is charged by the Alabama Secretary of State’s office and can vary based on the type of business entity being registered. Other costs associated with registration may include legal fees, as many business owners choose to work with a lawyer when filing their registration documents to ensure compliance with state regulations.

In addition to the filing fee and legal costs, business owners should also be prepared for ongoing expenses associated with maintaining their foreign LLC registration in Alabama. These expenses may include annual report fees, tax filings, and any other regulatory requirements imposed by the state. While these costs may seem burdensome, they are necessary to ensure that your business remains in good standing and compliant with state regulations.

Another important consideration when calculating the cost of registering a foreign LLC in Alabama is the potential impact on the company’s overall budget and financial health. By carefully assessing the costs associated with registration and ongoing compliance, business owners can determine whether expanding into Alabama is a cost-effective decision for their company. It’s also important to consider any tax implications that may arise from registering a foreign LLC in a new state, as these can significantly impact the company’s financial well-being.

Ultimately, the cost of registering a foreign LLC in Alabama is an important consideration for any business looking to expand into the state. By carefully evaluating the costs associated with registration, ongoing compliance, and potential tax implications, business owners can make an informed decision about whether the investment is financially viable for their company. It’s important to remember that while registration costs may seem high initially, the benefits of expanding into a new state can far outweigh these expenses in the long run.

In Conclusion

Starting a foreign LLC in Alabama does not require a lot of documentation or tasks. However, it is always good to seek help from a professional when it comes to running your business. Get a professional registered agent and form your foreign LLC anywhere without a hassle.